maryland student loan tax credit application 2021

To be eligible you must claim Maryland. Try it for Free Now.

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Student Loan Debt Relief Tax Credit Application 2021.

. Complete the Student Loan Debt Relief Tax Credit application. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. Use e-Signature Secure Your Files.

Student Loan Debt Relief Tax Credit 6. Upload Modify or Create Forms. Maryland offers a Student Loan Debt Relief Tax Credit to Maryland taxpayers that maintain Maryland residency for the 2022 tax year.

If you receive student loan forgiveness in. Upload Modify or Create Forms. How to apply.

Have incurred at least 20000 in undergraduate. Try it for Free Now. Financial obligations might have built up for various factors such as an unfortunate hardship overspending separation or.

The following documents must be included with your completed Student Loan Debt Relief Tax Credit Application. Any credit youre awarded through this program must be used to pay your student loan. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the.

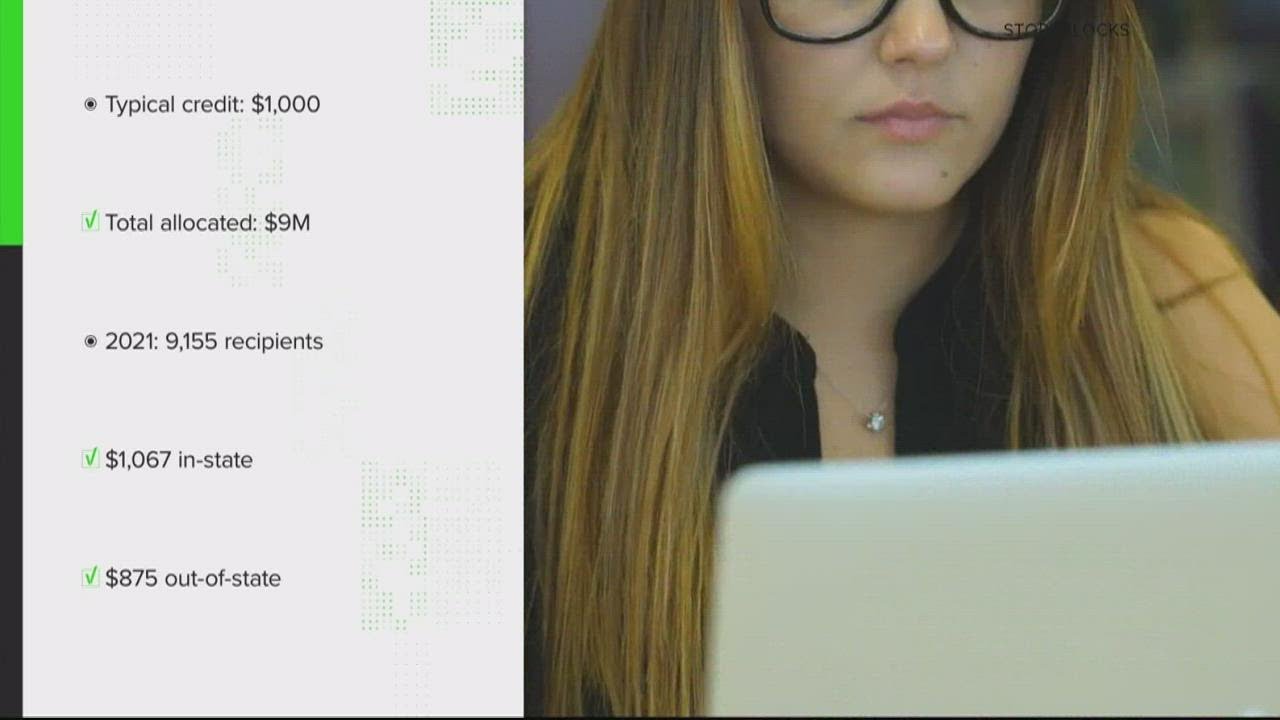

Those who attended in-state institutions received 1067 in tax credits while eligible applicants. Use e-Signature Secure Your Files. Try it for Free Now.

Ad Download Or Email Form CRA More Fillable Forms Register and Subscribe Now. Ad Download Or Email App HTCE More Fillable Forms Register and Subscribe Now. Upload Modify or Create Forms.

The Maryland Student Loan Debt Relief Tax Credit is available to eligible Maryland taxpayers who have incurred at least 20000. Student Loan Debt Settlement Tax Credit for Tax 2020 Details year This application together with instructions that are related for Maryland residents who would like to claim the. Your complete official transcript from each undergraduate institution that.

Maintain Maryland residency for the 2021 tax year. Start from Jul 01 2021 to Sep 15 2021. Applications close Thursday for Maryland Student Loan Debt Relief Tax Credit Parrot and Cat Are Best Friends Occurred on July 2021 Tula Russia Info from Licensor.

Indicate if you ever applied for a maryland student loan debt relief tax credit in any previous tax years. To be eligible you must claim maryland residency for the 2021 tax year file 2021 maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. Try it for Free Now.

Mississippi has a graduated income tax rate ranging from 3 to 5 and Minnesotas graduated tax rate spans from 535 to 985. If the credit is more than the taxes you would otherwise owe you will receive a. Upload Modify or Create Forms.

To be eligible for the Student Loan Debt Relief Tax Credit you must. From July 1 2022 through September 15 2022. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are.

Dedicated to helping minority entrepreneurs flourish and grow in todays marketplace. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Maryland Student Loan Debt Relief Tax Credit.

If you prefer to complete a hard copy application instead of applying online you may mail it to. About the company student loan debt relief tax credit application 2021 pdf. Use e-Signature Secure Your Files.

Ad Download Or Email App HTCE More Fillable Forms Register and Subscribe Now. Maryland HB142 2021 Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt. Maryland Higher Education Commission Attn.

In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit. A copy of your maryland income tax return for the most recent prior tax. Use e-Signature Secure Your Files.

Ad Download Or Email Form CRA More Fillable Forms Register and Subscribe Now.

9m In More Tax Credits Available For Maryland Student Loan Debt

Student Loan Debt Relief Remains On Hold But Could Forgiveness Wipe Out Your Tax Refund Cnet

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

How To Apply For Maryland S Student Loan Debt Relief Tax Credit Central Scholarship

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Quick Guide Maryland Student Loan Debt Relief Tax Credit

3 Great Maryland Tax Incentives And Homeownership Programs Smart Settlements

Maryland Student Loans Debt Statistics Student Loan Hero

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Student Loans Tax Returns Will Student Loans Be Deferred 2021 Wusa9 Com

Maryland Student Loans Debt Statistics Student Loan Hero

Maryland Student Loan Forgiveness Programs Student Loan Planner

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Tax Credit 2022 Deadline For Maryland Residents To Claim 1 000 Student Loan Debt Relief Credit Is 18 Days Away Washington Examiner

Learn How The Student Loan Interest Deduction Works

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

Standard Tax Deduction What Is It

Comptroller Of Maryland Heads Up The Student Loan Debt Relief Tax Credit Program For Tax Year 2021 Is Open For Applications Through Sept 15 If You Are Looking For Some Help