GST payment

Tax refunds made via cheques. Payments can be received through direct.

3 months after fiscal year-end.

. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November. Goods and Services Tax. For example the taxable period ending 31 May is due 28 June.

The GST credit program comes in the form of quarterly payments. GST Payment Dates in 2022. Pay domestic GST Use this account number if youre paying any amount due on your GST return to Revenue Jersey Quote your GST registration number as your reference Bank.

Your GST payment is due on the same day as your GST return. GSTHST payment and filing deadlines Payment deadline Filing deadline Example. The amount is calculated based on your family situation in October.

Challan History Track Payment Status. A sign outside the Canada Revenue Agency is seen in Ottawa Monday May 10 2021. 201 Ottawa unveils 45B affordability plan including dental care GST credit Millions of Canadians woke up Friday morning with hundreds of dollars from Canadas federal.

This is an amount we. The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. This is the 28th of the month after the end of your taxable period.

The tax credit only applies to. Goods Services Tax GST Login. Monthly if your GST turnover is 20 million or more.

OTTAWA ON Nov. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April. Canadians eligible for the GST rebate can expect to receive an additional lump sum.

GST ePayment is an introduction about GST Act GST Tax Rate GST Updates GST Notifications GST Rules GST Payment Register GST and many more. Application for Deferred PaymentPayment in Instalments. GSTHST Payment Dates for 2022.

You can claim a GST refund if your customer has not paid you within six months of the sale Completing your GST return A step-by-step guide to completing your GST return online. If your business income is reasonably consistent throughout the year you might prefer to pay a GST instalment amount option 3 in your business activity statement. 3 months after fiscal year-end.

4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the. Share this article. Grievance against PaymentGST PMT-07 Grievance.

The payment dates for GST and HST this year are. This one-time GST credit payment will be double the amount of the GST credit you would receive over a six-month period. If you do not receive your GSTHST credit.

Quarterly if your GST turnover is less than 20 million and we have. End of reporting period. Your GST reporting and payment cycle will be one of the following.

Canadas new extra GST credit payment is rolling out in the near future like next week near and if youve been eligible in the past its worth checking if youll benefit from. Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the date of the tax credit arises. Therefore those who apply and qualify can receive four special payments from the Canadian government each.

If you are already entitled to receive the GST credit in October of this year you will automatically qualify for the one-time GST payment top up. Goods Services Tax GST Payments.

Can Not Make Gst Payment On Remittance Module General Discussion Sage 50 Accounting Canadian Edition Sage City Community

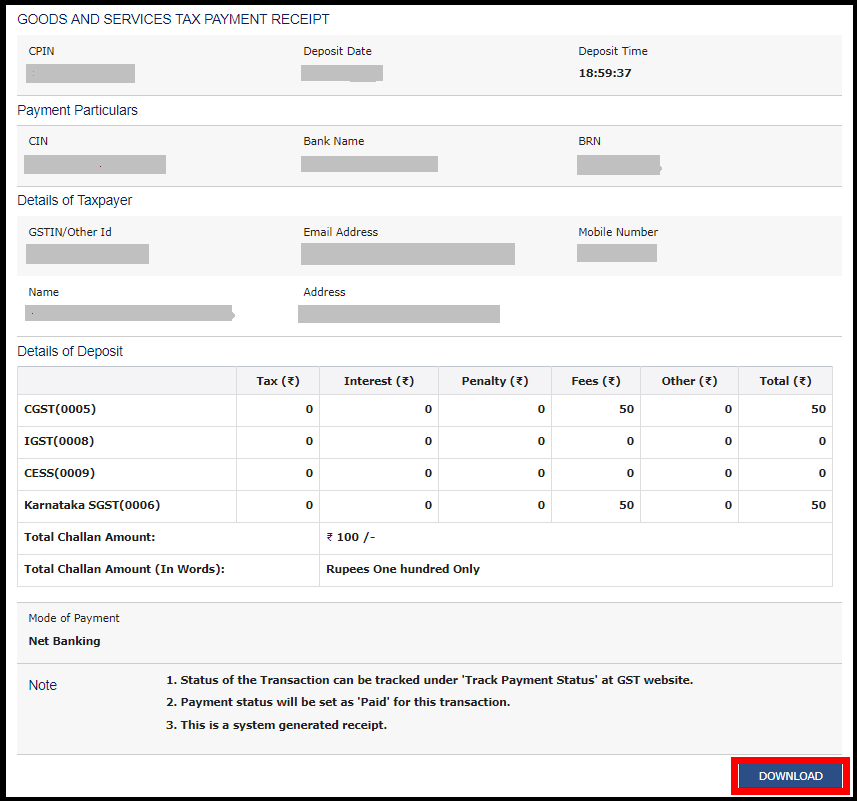

Gst Payment Challan Gst Pmt 06 Masters India

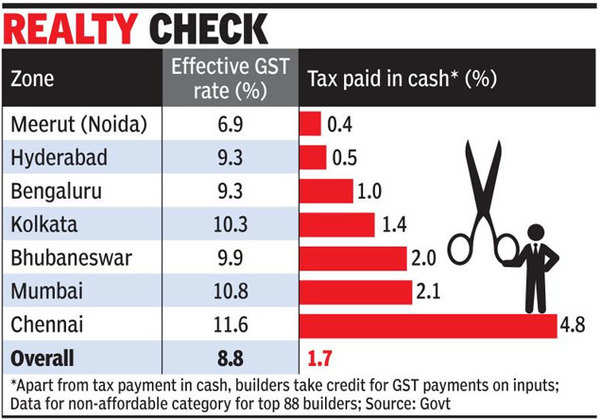

Are Realtors Evading Gst With Fake Invoices Times Of India

Track Gst Payment Status Online Learn By Quicko

How To Raise A Complain On Gst Payment Issues Consult4india

Gst Payment Online Status Timings Process Paisabazaar Com

Training Modular Financial Modeling Ii Sales Taxes Gst Gst Payment Timing Modano

Good News Gst Taxpayers To Get Flexibility To Decide On Monthly Tax Payment Zee Business

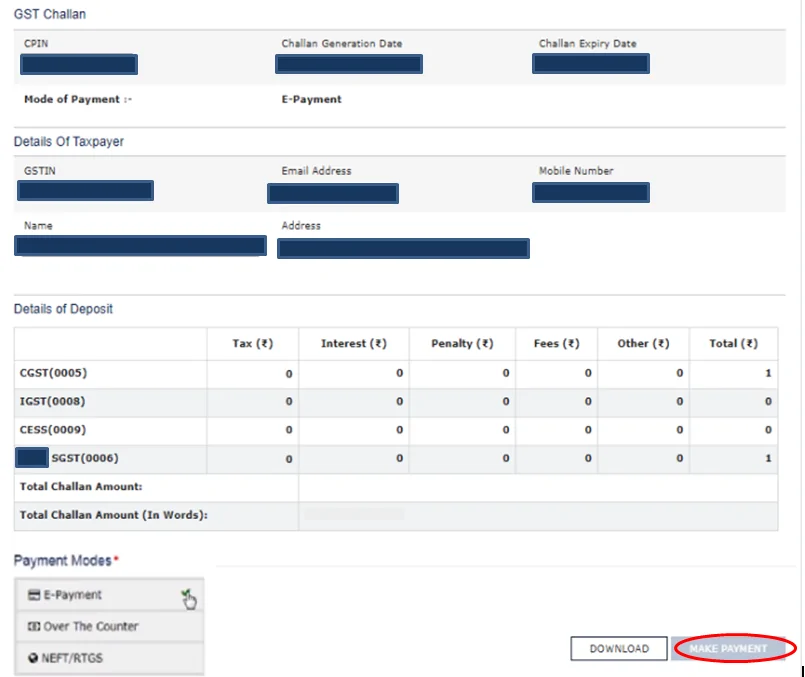

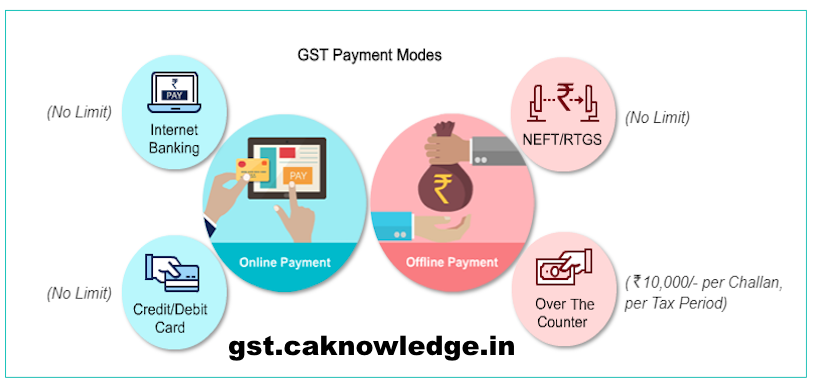

Make Online And Offline Gst Payments Post Login

Gst Online Payment Process Mybillbook

Steps By Step Guide To Make Gst Payment Tax Payment In Gst

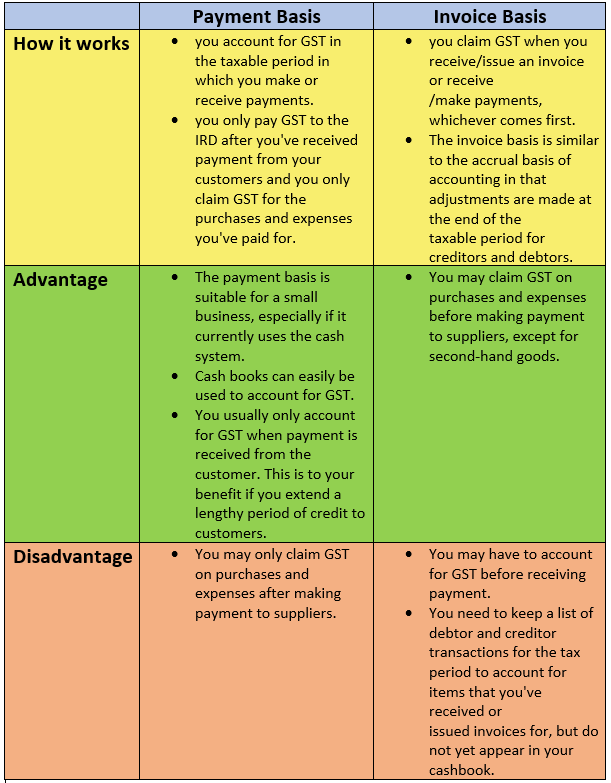

Gst Payment Vs Invoice Basis The Career Academy Help Centre

Gst Challan Payment Process To Pay Gst Online Learn By Quicko

List Of Gst Payment Forms Types Of Gst Payment Gst Portal India

Export Of Goods Without Payment Of Igst Gst Refunds Part 1

Training Modular Financial Modeling Ii Sales Taxes Gst Gst Payment Timing Modano